This is the podcast for the Notes on the Crises newsletter published by Nathan Tankus. The newsletter (and now the podcast) is devoted to covering the ongoing effects of the Coronavirus Depression and various other related and intersecting crises Nathan will interview guests on a variety of related topics and take the opportunity of speaking to experts, authors and academics to explore issues the newsletter doesn‘t usually cover at a deeper level. Support the podcast and Newsletter by Subscribing at https://www.crisesnotes.com/#/portal

Episodes

Thursday Oct 06, 2022

Thursday Oct 06, 2022

On this episode we have a very special guest, economist Daniel Mitchell on his time as the chief economist of Nixon’s pay board, the “wages” part of wage and price controls. He is also coauthor, along with “public” member of the 15 person Pay Board Arnold Weber, of a book on the Pay Board experience called The Pay Board’s Progress: Wage Controls in Phase II.

On this episode Professor Mitchell and Nathan discussed the previous experiences with wage and price controls (sometimes called “incomes policies”) which informed Nixon’s Wage and Price Controls, Nixon’s opposition to wage and price controls… until he did them and what his first months at the Pay Board were like. They also discussed the theory behind wage and price controls at the time, the focus on organized labor and the importance of George Meany, long time head of the AFL-CIO, to the Pay Board’s tenure. The last part of the interview focused on the Pay Board’s awareness and sensitivity to questions like “inflation expectations”, Professor Mitchell’s view of the Federal Reserve’s focus on wage control and “wage bargaining” and how confident economists should be that the questions of full employment and price stability have been definitively answered.

You can find the paper “Not Yet Dead at the Fed” here.

Listen here.

If you would like to support Notes on the Crises, subscribe here.

Produced & Edited by Lina Nehlich

Wednesday Mar 02, 2022

Wednesday Mar 02, 2022

In our third episode Nathan spoke to Karina Patricio Ferreira Lima, a law professor at the University of Leeds, and Chris Marsh, a macroeconomist at Exante Data, about their paper questioning the legality of the International Monetary Fund’s 2018 program in Argentina. The interview runs through the important background history to the IMF’s most recent Argentine program, the questionable changes which have been made to the IMF’s operating procedures in the past few decades and the legal constraints which are supposed to exist for IMF programs. Our guests went on to explain the specifics of the 2018 stand-by arrangement with the IMF and the reasons they think this program was particularly egregious economically, to the point of being illegal. Finally, we discussed the limited legal recourse Argentina has to challenge the legality of an IMF program and the implications all this has for the IMF’s Coronavirus response. This interview was recorded before the recent Ukraine crisis, but has obvious implications there too.

You can find their paper here. You can follow Professor Lima here and Chris Marsh here.

You can also find the podcast on Podbean (including RSS feed)

If you would like to support Notes on the Crises, subscribe here.

Produced & Edited by Lina Nehlich

Thursday Dec 09, 2021

Notes On The Crises Podcast #2: Adam Tooze Talks Shutdown

Thursday Dec 09, 2021

Thursday Dec 09, 2021

Notes On The Crises Podcast #2: Adam Tooze Talks Shutdown

On this month’s episode Nathan talked to Adam Tooze, history professor at Columbia University, about his new book Shutdown: How Covid Shook the World's Economy. Nathan and Adam wound the clock back to January 2020 to talk about what the world looked like then and the bizarre series of responses- or non-responses- to the coming Coronavirus crisis coming into March of 2020. Then they talked about the first events that really woke the public, and policymakers, up about what was coming and the ad-hoc policy response in March and April in the United States and Europe. From there they turned to how the response looked globally and the successes many- but not all- countries in Asia, South America and Africa had in responding to the crisis. Finally, they meditated on the failure of coordinating an international response and the reprehensible neglect of foreign-denominated debt relief and financial support to those countries unable to weather the financial fallout from the global pandemic depression.

Find Shutdown here, and wherever books are sold. Find Professor Tooze’s newsletter here.

You can also find the podcast on Podbean (including RSS feed) and it will be distributed to various other podcast apps shortly.

If you would like to support Notes on the Crises, subscribe here.

Produced & Edited by Lina Nehlich

Wednesday Nov 03, 2021

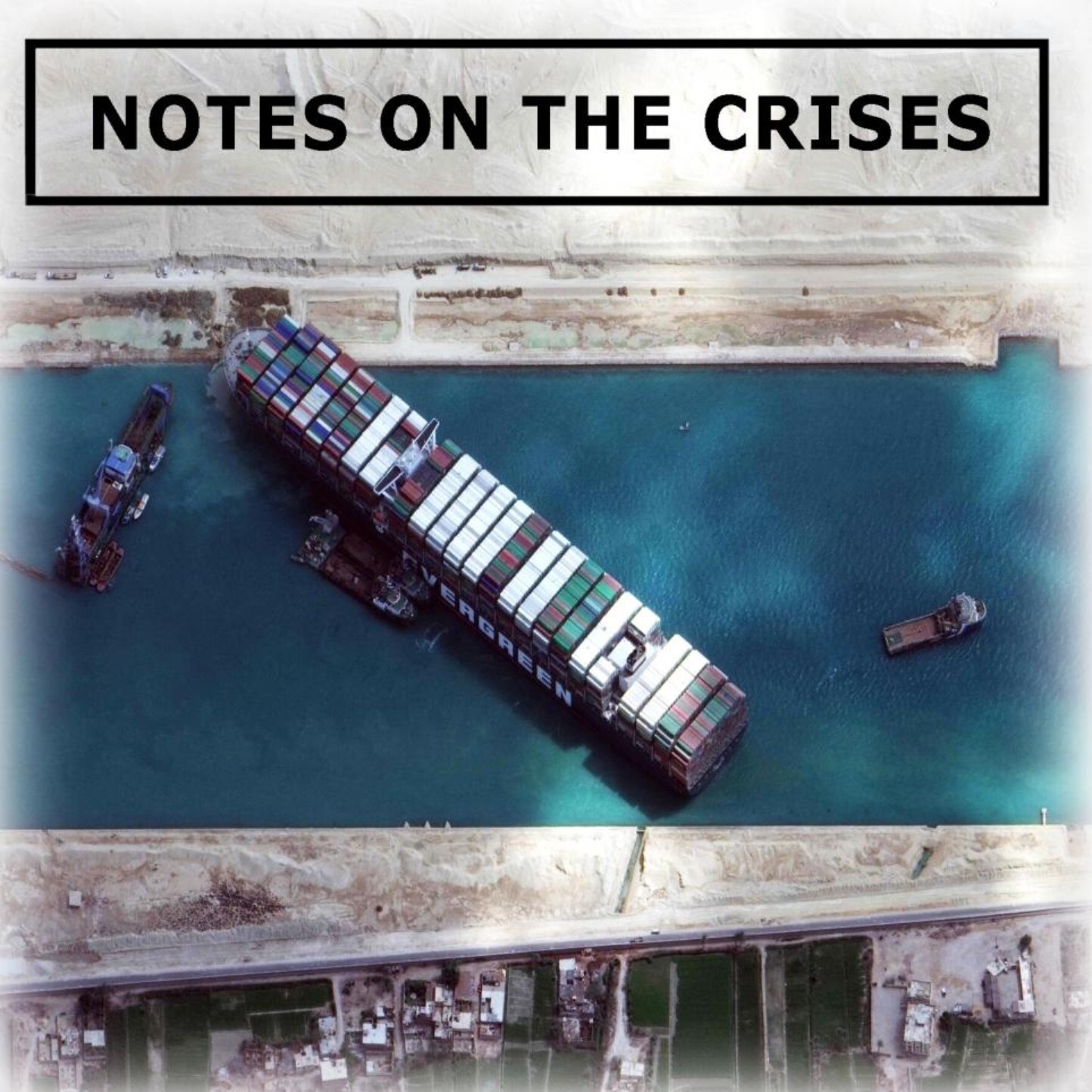

Notes on the Crises Podcast #1: Joe Weisenthal on Supply Chains

Wednesday Nov 03, 2021

Wednesday Nov 03, 2021

On the first episode of the new Notes on the Crises Podcast, Nathan talked to Joe Weisenthal. Joe is a Bloomberg journalist, co-host of the Odd Lots podcast and co-manager of the Odd Lots blog. They talked about all things supply chains. Joe has been interviewing various experts about every component of global supply chains for the past six months, and offers our listeners a fresh perspective about what’s going on with shipping, freight and logistics worldwide.

This episode explores the impact the Great Financial Crisis had on supply chains. Nathan and Joe talk through the implications of the global crisis both for labor conditions in the supply chain (particularly trucking), and climate change. From the big picture, down to the specifics of what’s going wrong specifically with the Ports, Trucking, and Rail.

Listen here

If you would like to support Notes on the Crises, subscribe here:

https://www.crisesnotes.com/#/portal

Produced & Edited by Lina Nehlich:

http://patreon.com/workstoppage